Pro Hacks For Obtaining Your Downpayment

BY MICHAEL ROBLETO August 25th, 2021 5:56 PM PST

Realtor with Compass Pasadena. Specializing in the buying and selling of Pre-War, Historic, and Architecturally significant homes and lofts in Altadena, Pasadena, Eagle Rock, Highland Park, Silverlake, Los Feliz, and DTLA.

Undoubtedly the biggest challenge for first-time home buyers is the down payment.

Coming up with such a large sum of money is the number one reason many renters don’t take the leap into homeownership but it may not be as grim as you think.

The goal of this article is to give you a primer on what these down payment hurdles are and how you may be able to jump over them.

Housing Prices

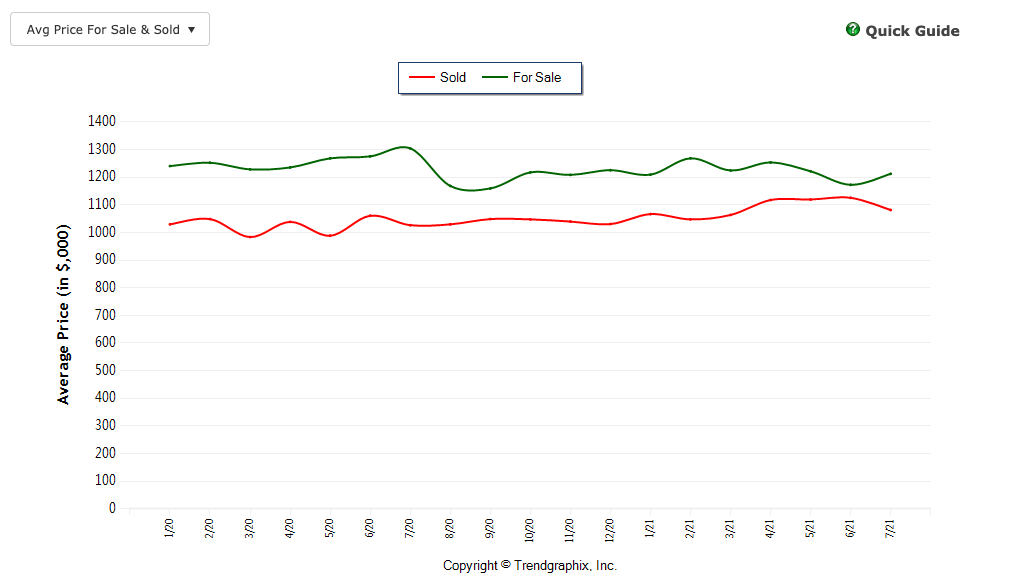

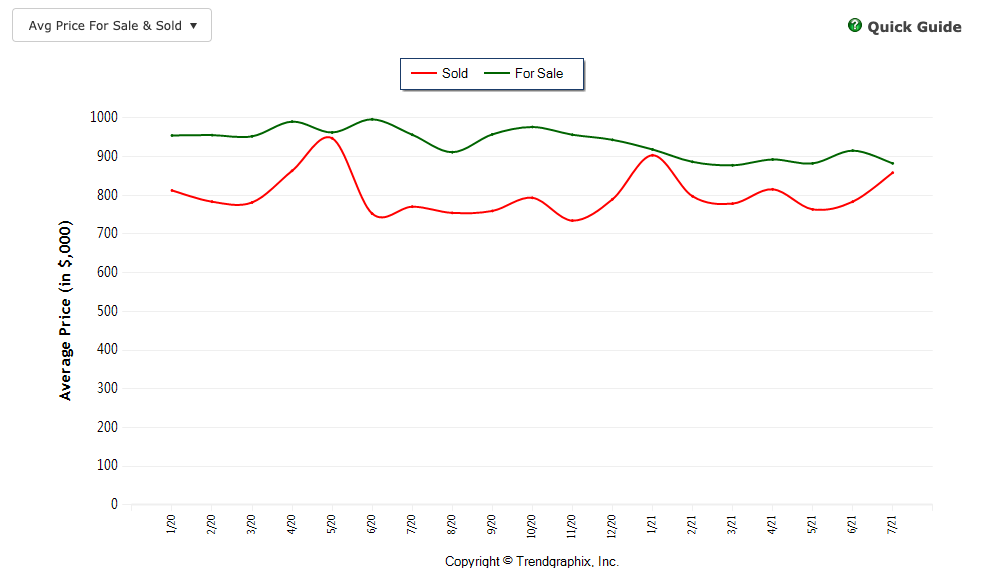

The housing stock in SoCal is pricey, one of the highest in the nation, and your down payment is going to be a percentage of the purchase price. The reason for the high prices is obvious to those that live here: job opportunities are ample, the quality of life is superb as we have cultural diversity, easy access to nature (mountains, oceans, deserts), entrepreneurship flourishes here and without a doubt, the best weather in the nation.

It is for these reasons we have the global demand to be California Dreamin’. That demand is not going to cease in your life so you need to come to accept the fact that prices are what they are. Hoping for a housing crash whether due to the pandemic or mysterious housing price cycles is only going to keep you farther away from being a homeowner. In other words, a price crash that you can take advantage of is not going to happen.

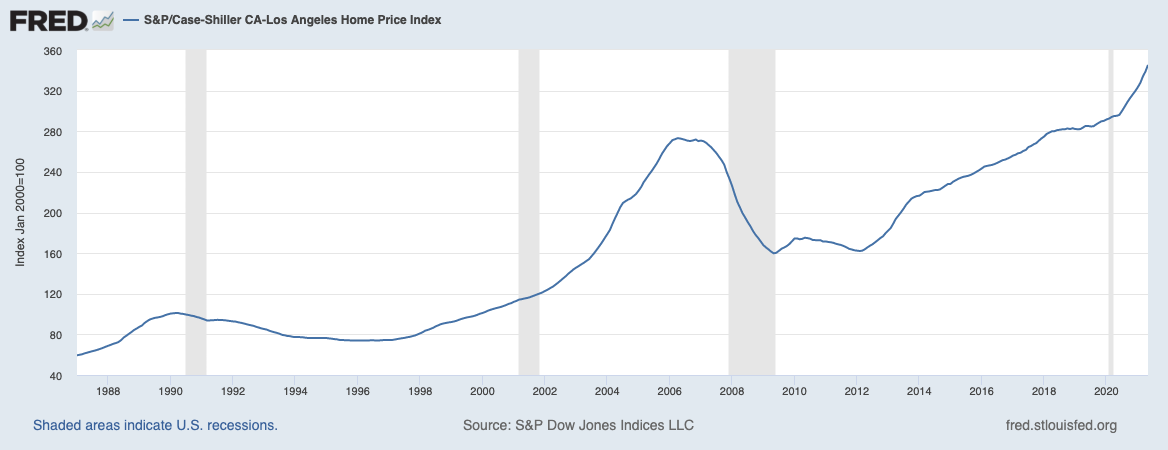

There has been only one time in the last 30 years that home prices in Los Angeles have plummeted and it was during the Great Recession and solely due to extremely loose mortgage rules. When the barista at Starbucks owns three houses, there is a problem. Those rules have now forever changed and we will not see that situation again.

Those rules have now forever changed and we will not see that situation again.

During the peak of the Pandemic, it was only condo prices that dropped for a few months, but most of us were too worried about the future to purchase a new condo.

The fact is, during a massive disruption, only those flush with cash will speculate on housing. You are reading this article, so you are not sitting on millions. I know home shoppers that started looking five years ago hoping for a crash and are now only farther away from the goal and not getting any closer.

Rather than dwell on house prices, think in terms of the monthly mortgage you can afford.

The Monthly Nut

There are monthly calculators on Bankrate link that can give you an idea, but the best way is to talk to a mortgage lender. They will run your specific numbers and tell you what is possible based on your debts and income. Good mortgage lenders are busy, don’t fear that they are gonna hound you to buy something. They aren’t salespeople in that aspect.

Once armed with what you truly qualify for you will know how much house you can buy.

If that amount equates to a house smaller than what you hoped for or in an area that you thought was horrible, then you should think creatively about the usage of space or take a closer look at some transitioning neighborhoods.

Remember, on average, people move every seven years, even homeowners. Don’t think in the “forever home” mindset if it is not ideal.

Fixer-uppers that have room for an addition or neighborhoods that are positioned to improve over time are great options. Twenty years ago, Highland Park was not the highly desirable hipster enclave that it is today. There are some areas, that I believe will be the next Highland Park.

Just because you can’t buy a home in the perfect neighborhood, shouldn’t prevent you from becoming a homeowner, play your cards right and your second home could be in that picturesque tree-lined neighborhood.

A good realtor will help you figure out neighborhoods and spaces that can work and talk you out of those that don’t.

Getting That Big Chunk of Change

In the Southern California markets that have high demand (which is a lot but not all) you will need to put 20% down. This is primarily due to competition, competing offers look better with at least 20% down because these buyers are most likely to have their loans funded vs someone that is not putting 20% down.

Secret tip, you can offer 20% down during the offer phase and then switch to 10%, 15% or possibly event 5% down during escrow, just make sure you have a very frank discussion with your lender before attempting this. You could jeopardize your deposit if you can’t secure that loan.

For housing that is in less demand (condos in Downtown LA for example) or a home that has been on the market for 30 days or longer, your odds of having an offer accepted for less than 20% down is very likely.

One word of caution when buying a home without 20% down; loans with less than 20% down will require you to pay for a monthly Private Mortgage Insurance (called PMI). This is a percentage of the loan amount and will be in the hundreds of dollars. You will have to pay this until you have 20% equity and re-finance. Lending hundreds of thousands of dollars of a bank’s money is risky for the lender, especially if you don’t have a lot of skin in the game, they want assurance you can pay and that assurance is PMI. While paying PMI is not ideal, at least you will not be wasting money on rent anymore.

Time IS of The Essence

Would-be homebuyers are encouraged to make their move soon, while this is always the mantra from Realtors, this urgency is based in fact. Home prices will go up again next year, not the 15% we saw this year but a more modest 3-4% as indicated by the John Burns Data Thinktank.

Adding to the urgency is record low-interest rates that we have enjoyed all pandemic long. Those are going away 100%. The Federal Reserve announced in June that interest rates will be raised twice between now and the end of 2023. Industry analysts believe we will start seeing modest bumps before the end of 2021. An increase in one percentage point will equate to thousands of dollars in mortgage payments per year.

We will start seeing modest bumps before the end of 2021.

Down Payment Assistance

There are some state-run down payment assistance programs that you may qualify for. CalHFA is one, The US Department of Housing and Urban Development (HUD) has others but I have not experienced a client utilizing one of these first hand but it is worth exploring.

Gift Funds

Many first-time home buyers will get assistance for their down payments. Parents can gift you part or all of the down payment, it just needs to “season” in your account for 60 days. Inheritances, legal windfalls, or even a Dogecoin cash-out could be all you need to get to that down payment. Buying a property will always be a better move than buying a fancy new car that will lose value quickly.

Taking the leap into homeownership can be daunting, but it is possible. With a good realtor and a local lender that can walk you through the options you too can make the leap from renter to homeowner in Southern California.

If you have questions, and every homebuyer does, I am always available to listen.

Michael Robleto

Realtor @ Compass

michael.robleto@compass.com

213.595.4720

MORE ARTICLES

Michael Robleto is a Los Angeles based REALTOR® that specializes in Historic, Pre-War and Mid-Century homes in Pasadena, Altadena and east side cities like Los Feliz, Silverlake, Eagle Rock, and Mount Washington. Michael uses his vast knowledge of older homes, residential construction, and modern-day marketing to predict and solve the many problems that arise in real estate transactions. His client accolades of insight, prompt communication, integrity, and hard work support the fact that he is not your average agent.

Michael leverages his personal passion for historic architecture to provide his clients with the unknown insight into the pros and cons of older homes. Michael, the son of a contractor, a California native, grew up in an older Bungalow home and has spent 23 years in Southern California admiring the unique architecture of the region. Michael brings 20+ years of negotiation and sales experience to his seven-year career in residential real estate. He often writes on homeownership strategy, historic residential architecture, and related topics that can be found on Facebook, YouTube, Twitter, and Instagram under the common profile name of his blog; BungalowAgent.

Michael sits on the Board of Directors of Pasadena Heritage and is frequent volunteer for the preservation efforts of numerous historic neighborhood associations and the LA Conservancy. When not working you can find Michael on hiking trails statewide with his faithful German Shepherd Axel.