What Those Changes in Interest Rates Really Mean to You

BY MICHAEL ROBLETO April 06, 2022 1:56 PM PST

Realtor with Compass Pasadena. Specializing in the buying and selling of Pre-War, Historic and Architecturally significant homes and lofts in Altadena, Pasadena, Eagle Rock, Highland Park, Silverlake, Los Feliz and DTLA.

Homebuyers don’t have it easy in Southern California these days. Record low choices for homes, insane competition with other buyers, and now, interest rates are creeping up.

What does it really mean when interest rates go up to you the homeowner and what strategies do you have to make the best of the challenging situation? Let’s dive in.

How Do the Rate Hikes Impact Me?

Increases in interests rates affect not just mortgages but car loans, credit card interest rates, and more and those little increases can add up over time.

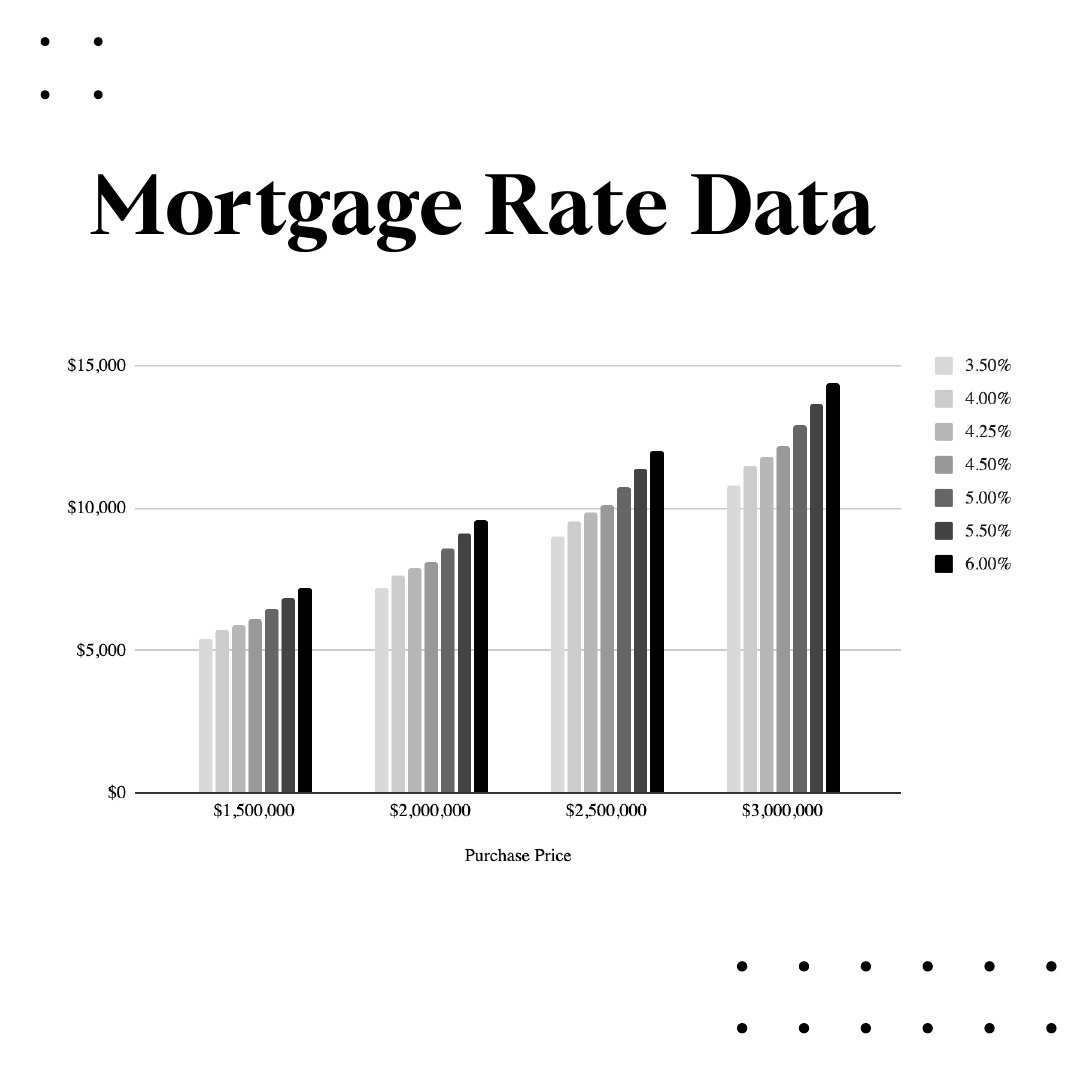

Rather than go into the history of the Federal Reserve and how it translates to the rate you get, I am going to keep this concise and focus on real-world scenarios and how it specifically affects your monthly mortgage payment and what it means over time.

Interest rates have been record low since just before the pandemic. However, they have been going up since late 2021 and they will continue to go up throughout the year and most likely into 2023. The Federal Reserve has confirmed this and every expert agrees that they will continue to go up in the hopes of curbing inflation. Some say that the Fed will increase the rate up to seven times this year. When the Fed raises the rate, mortgage rates go up. Fed rate hikes are usually in small increments of .25% or .5%.

NOTE: Lenders are not in lockstep with the Fed on rate changes, so the actual mortgage you get could jump more than the Fed rate hikes.

So, who cares if the rate goes up .25 percent? Well, as you will see below, it’s not a huge chunk of change monthly, but it will certainly add up, especially on higher-priced properties.

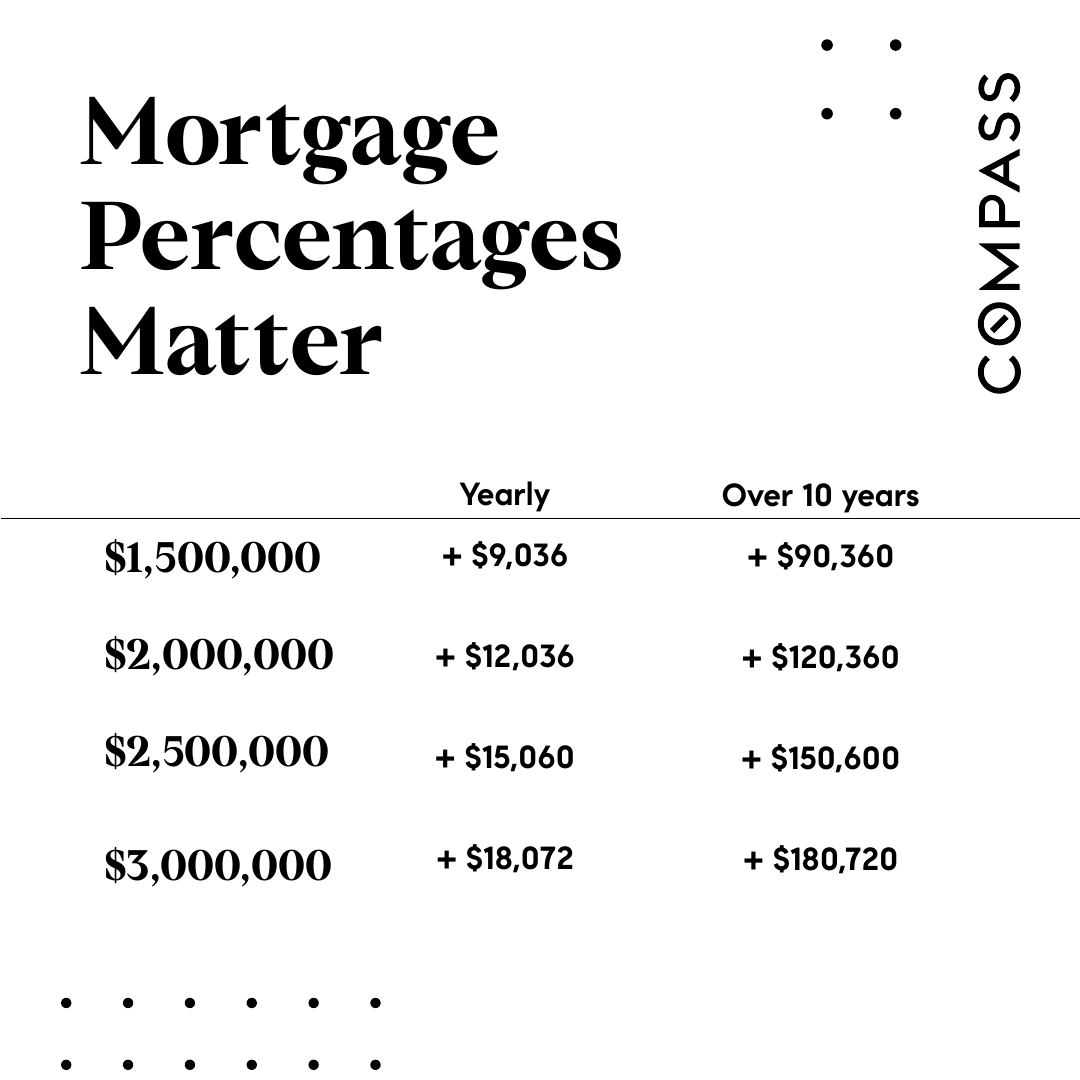

Remember, unlike our parents who moved into a house and stayed in that house for 40 years, the current average for homeownership is ten years. So, let’s keep the ten year factor in mind.

Wow, That Really Adds Up

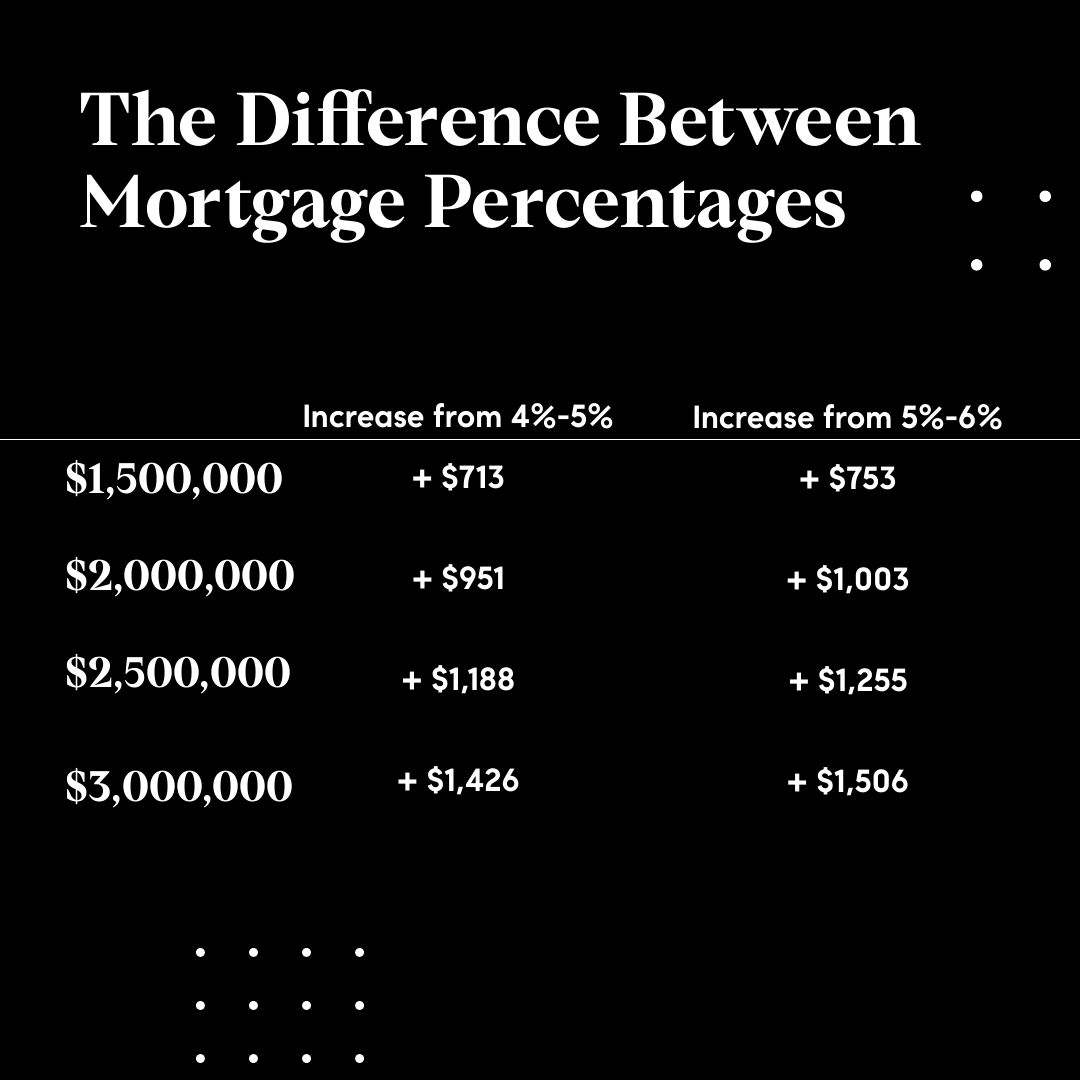

As you can see in the chart above, the difference between 5% and 6% on a $2,000,000 home, the monthly difference in rate is over $1,200. That is $15,000 a year and $150,000 over that ten-year period you will most likely own that house. That’s six figures of just interest. That is significant.

These little increments add up over time, but what is most concerning is where interest rates are headed. Many experts predict seven Federal Interest Rate hikes this year. If each one is .25%, that is a 1.75% increase from today.

Keep in mind that interest rates vary from lender to lender (hence why I advise my clients to shop their loan once in escrow). Last month, I called three lenders all within an hour; one was 3.5%, another was 3.75% and the third was 4.5%. That is a pretty major swing, you want to shop around.

Lets take a conservative average rate of 4.25%, add in the conservative base rate increase that is likely to happen of 1.75% and we are easily sitting at 6% by the end of the year and your monthly mortgage payment increase is equivalent to two car payments or the downpayment on another home in ten years.

What Can I Do About It?

Waiting is your worst option. Hoping there will be a crash is a foolish approach. Crashes don’t just affect home prices, they affect employment, your security, and the overall economy. Thinking you will be in a safer place to buy a home in an unlikely crash is just foolish optimism.

The best thing is to start taking the steps to become a homeowner. Get PreApproved for the mortgage so you know what you qualify for and what monthly mortgage is doable. Then find an agent that is willing to put in the time with you.

You need to tour a lot of properties, and no, doom scrolling Zillow does not count. I always advise buyers that you won’t get a true sense of the market and what will work for you until you tour 30 places. It only then do you really know your true needs. The benefit is, that you will be able to move quickly when that right one comes up and you have only three days to make an offer on it.

Make Some Sacrifices

Buyers will also need to accept that some sacrifices will need to be made. It will either be location, condition, the size of the home, or a combination of all three. Of these three, I am always a fan of buying a home that needs renovations. You can live in it while you do these and you can you do it over time as your budget allows. Having an agent that intimately knows home construction will help ensure that you aren’t buying a lemon.

While many want to live in prime neighborhoods, there are some hidden neighborhoods that may not be on your radar, keep the geography wide and be flexible on adding to your commute time. If you are working from home now, leverage this.

A Condo Could Be The Solution

Buyers should always keep condo options on their list. Condos are simple, with little maintenance, and many times they can still be updated to see a positive effect on value. If the budget is tight, condos could be a great solution for the next five years. After which, you can sell it or rent it out and build that portfolio.

I know the market is tough, I know there is a lot of competition. Be wary of the hype that says a crash is coming. Real estate is an investment, there are strategies to beat any downturn in the market (which is very, very, very unlikely).

Couple of things to remember, I am not a mortgage broker, I am a real estate agent, I asked lenders I work with often for much of this data. To secure a loan, you will need to talk to a lender, I get you the home, not the loan. If you need a lender, I have some amazing ones.

If you have been sitting on the fence and want to get in the market before it really gets too expensive, reach out, I am always glad to help.

Michael Robleto

Realtor @ Compass

michael.robleto@compass.com

213.595.4720

MORE ARTICLES

Michael Robleto is a Los Angeles based REALTOR® that specializes in Historic, Pre-War and Mid-Century homes in Pasadena, Altadena and east side cities like Los Feliz, Silverlake, Eagle Rock, and Mount Washington. Michael uses his vast knowledge of older homes, residential construction, and modern-day marketing to predict and solve the many problems that arise in real estate transactions. His client accolades of insight, prompt communication, integrity, and hard work support the fact that he is not your average agent.

Michael leverages his personal passion for historic architecture to provide his clients with the unknown insight into the pros and cons of older homes. Michael, the son of a contractor, a California native, grew up in an older Bungalow home and has spent 23 years in Southern California admiring the unique architecture of the region. Michael brings 20+ years of negotiation and sales experience to his seven-year career in residential real estate. He often writes on homeownership strategy, historic residential architecture, and related topics that can be found on Facebook, YouTube, Twitter, and Instagram under the common profile name of his blog; BungalowAgent.

Michael sits on the Board of Directors of Pasadena Heritage and is frequent volunteer for the preservation efforts of numerous historic neighborhood associations and the LA Conservancy. When not working you can find Michael on hiking trails statewide with his faithful German Shepherd Axel.