The 2026 Housing Market: Lessons From 2025 and What Comes Next

What Really Happened in the 2025 Housing Market

At first glance, the 2025 housing market doesn’t look disastrous. In many Los Angeles submarkets—Pasadena, Altadena, Silver Lake, Los Feliz, Eagle Rock—sales and new listings were modestly higher than in 2024.

But those headline numbers don’t tell the real story.

2025 wasn’t a frozen market. It was a friction-heavy market—one where activity existed, but outcomes were harder to achieve.

More homes came to market, but a smaller percentage of them actually sold. Listings sat longer. Price reductions became routine rather than exceptional. Many sellers entered the market with pricing expectations shaped by 2021–2022, only to discover that buyers—now constrained by higher interest rates and affordability ceilings—were no longer willing or able to stretch.

As a result, the market quietly split in three:

• Well-priced, highly desirable homes still sold—and sold reasonably well

• “Almost right” listings lingered, required multiple adjustments, and absorbed months of market time

• Overpriced or compromised homes often failed to sell at all, eventually expiring or being withdrawn

Those unsold listings don’t show up in sold-data charts—but they dominated day-to-day reality.

This is why 2025 felt so difficult for both sellers and agents. Transactions required more strategy, more patience, and more course correction. The work per deal increased, while the margin for error shrank. Even though some aggregate metrics improved year-over-year, the efficiency of the market declined.

In short:

2025 was a year of price discovery, not momentum.

That distinction matters—because it sets the stage for what comes next.

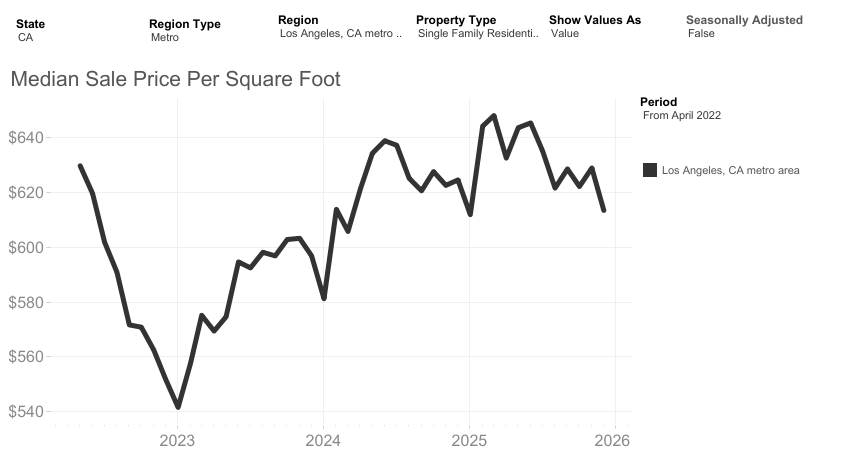

Price per square foot trends show how pricing expectations have shifted from 2022 through 2025.

What Sellers Should Expect in 2026

If 2025 was about price discovery, 2026 will be about preparation and execution.

Buyers are still in the market—but they are far more selective. When interest rates soften (and they will), more buyers will come out. That alone, however, won’t carry a listing. Rate relief may get buyers through the door. It won’t get them to write an offer.

What will? Confidence.

In 2026, sellers who succeed will do three things well: prepare the property properly, embrace transparency, and work with an agent who understands houses—not just marketing.

Preparation Will Matter More Than Ever

Older homes are not commodities. A house with galvanized plumbing is not the same as one with copper. A tired electrical panel is not the same as an updated system. Deferred maintenance isn’t a cosmetic issue—it’s a risk calculation for today’s buyer.

Yet I’m still surprised how often I walk into listings where the agent has little understanding of the home’s mechanical condition. Buyers notice. Inspectors will certainly notice. And unanswered questions create hesitation.

Pre-inspections, proactive repairs, and clear documentation will be key in 2026. Fixing known issues before listing doesn’t weaken your negotiating position—it strengthens it by removing uncertainty.

Transparency Builds Momentum

Today’s buyers don’t expect perfection. They expect honesty.

Clear disclosures, inspection reports, and thoughtful explanations help buyers move forward with confidence. When information is missing or vague, buyers assume the worst—or simply move on.

This is especially true in older neighborhoods like Pasadena, Altadena, Silver Lake, Los Feliz, and Eagle Rock, where homes have character, history, and complexity. Transparency isn’t a liability here. It’s a selling tool.

Marketing Gets Buyers In—Knowledge Gets Them to Write

Beautiful photography and strong online exposure still matter. They get people through the door. But once buyers are inside, the conversation shifts quickly from aesthetics to fundamentals.

How old is the roof?

What type of plumbing is in the house?

Has the foundation been evaluated?

What’s been updated—and what hasn’t?

This is where agent experience becomes critical. A large social media following won’t answer those questions. Understanding construction, materials, and systems will.

In 2026, the most effective agents will be those who can communicate clearly, calmly, and without sales pressure—guiding buyers through the decision rather than pushing them toward it.

Because in this market, confidence closes deals.

What Buyers Should Expect in 2026

For buyers, 2026 is shaping up to be a more functional—and potentially more favorable—market than the past few years.

Interest rates are already moving in the right direction. At the end of 2024, the average 30-year fixed mortgage rate was hovering in the mid-6% range, after peaking well above 7% earlier in the year. Rates eased modestly into the low-6% range by late 2025, and forecasts suggest they may continue slowly downward through 2026.

More importantly, the direction of travel matters. With leadership changes at the Federal Reserve expected in 2026, and inflation largely under control, the market is anticipating additional downward pressure on rates. That doesn’t mean a return to ultra-low borrowing costs—but it does mean buyers may find more stability and predictability than they’ve had since 2022.

More Choice, Less Urgency

Inventory rose in 2025, even if not all of it sold. That matters for 2026.

Homes that failed to transact last year didn’t disappear—they reset expectations. As sellers absorb the lessons of 2025, pricing is becoming more realistic, and that is already showing up in the data. Average price per square foot has softened from recent highs, particularly in PreWar and MidCentury markets where condition and updates matter. In prime neighborhoods, some homes may still see competitive bidding, but that won’t be the norm.

For buyers, this means:

More options to choose from

Fewer “must-win” bidding wars

Greater ability to compare, evaluate, and walk away

This is not a distressed market—but it is no longer a market that rewards impulsive decisions.

Leverage Comes From Information, Not Aggression

In 2026, the strongest buyers won’t be the loudest or fastest. They’ll be the most informed.

Buyers who understand condition, mechanical systems, and long-term costs will be better positioned to negotiate thoughtfully. Inspection contingencies, repair requests, and pricing adjustments are no longer taboo—they’re part of a normal transaction again.

Just as important is representation. An agent who can clearly explain what you’re seeing—what matters, what doesn’t, and what future ownership will actually look like—adds real value in this environment. This is especially true in neighborhoods with older housing stock, where every home tells a different story beneath the surface.

The Big Picture for Buyers

2026 won’t be about “timing the market.” It will be about using the market.

Rates are easing. Inventory is improving. Pricing is adjusting. Buyers who stay patient, focus on fundamentals, and rely on clear guidance—not pressure—will find opportunities that simply didn’t exist a year or two ago.

Looking Ahead

The 2026 housing market won’t reward guesswork. It will reward preparation, clarity, and informed decision-making.

For sellers, that means understanding how your home truly compares in today’s market—not last year’s. For buyers, it means recognizing where leverage exists and how to use it responsibly. In both cases, success will come from good information and realistic expectations.

If you’re considering a move in 2026—or simply want a clearer read on how these shifts apply to your specific neighborhood or property—I’m always happy to talk through it. No pressure, no sales pitch—just an honest conversation about where the market is and how to approach it thoughtfully.

As always, I’ll continue sharing data-driven insights here as the year unfolds.

Michael Robleto

PreWar & MidCentury Specialist

Compass

213-595-4720

michael.robleto@compass.com

About The Author

Michael Robleto is a Los Angeles–based REALTOR® specializing in historic, pre-war, and mid-century residential properties, with a focus on Pasadena, Altadena, and Eastside neighborhoods including Los Feliz, Silver Lake, Eagle Rock, and Mount Washington.

Known for his deep understanding of older homes and residential construction, Michael helps clients navigate the complexities of historic properties—from aging mechanical systems to long-term ownership considerations. His approach combines data-driven guidance with thoughtful, modern marketing, allowing clients to make informed decisions in changing markets.

A California native and the son of a contractor, Michael grew up in an older bungalow and has spent more than two decades studying Southern California’s residential architecture. He currently serves as Chairman of the Board of Pasadena Heritage and writes about homeownership strategy, architecture, and market dynamics through his Bungalow Agent platform.