Market Watch LA: The Road Ahead For Home Prices

Market activity is always a topic of conversation for a realtor. Our time in the trenches gives us a good sense of what is going on and we are always glad to share. In a global pandemic, this question comes up frequently. Owners are concerned about value, buyers are hoping to time the trough of the market.

Analyzing data give us the hard facts that we can all appreciate. Global activity will always shape the real estate market and we often hear media outlets clamoring about national numbers.

However, national numbers hold little relevance to home buyers and home sellers. Statewide numbers just the same, heck, LA County numbers don’t tell the true tale of “How’s the Market”

To get a sense that matters to you, we have to dive deep into the specific numbers relative to you.

Here is some data on the markets where my skills as a historic specialist come into play most often. If there is a neighborhood you are curious about or a different data set, just ask. Truth be told, I love looking at these data sets.

Historic Pasadena

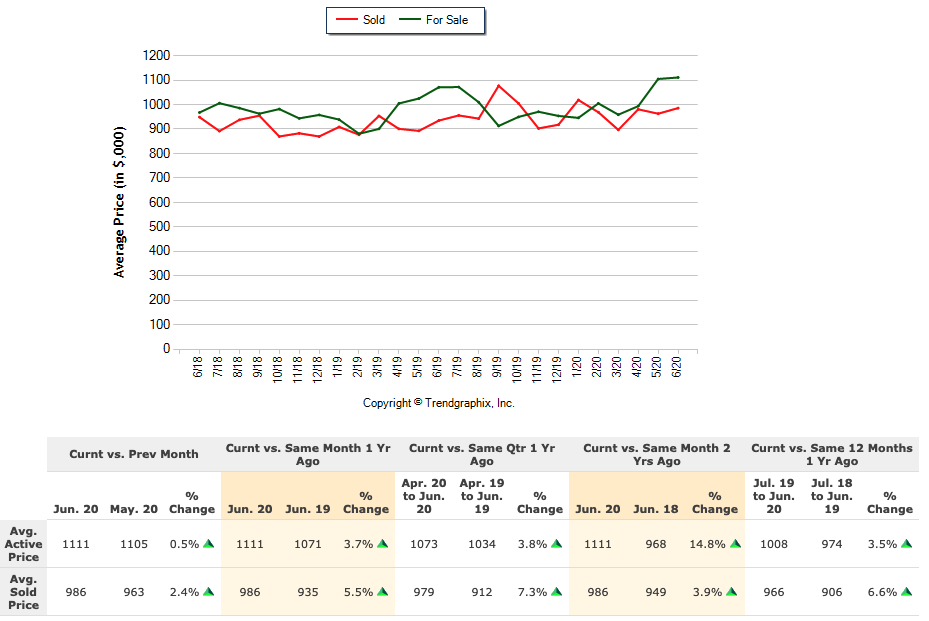

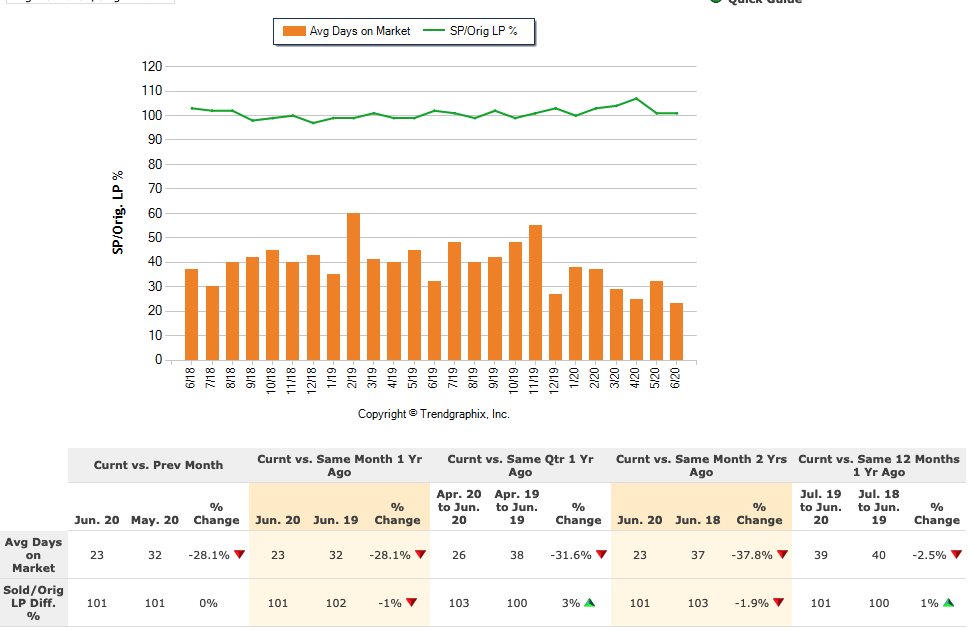

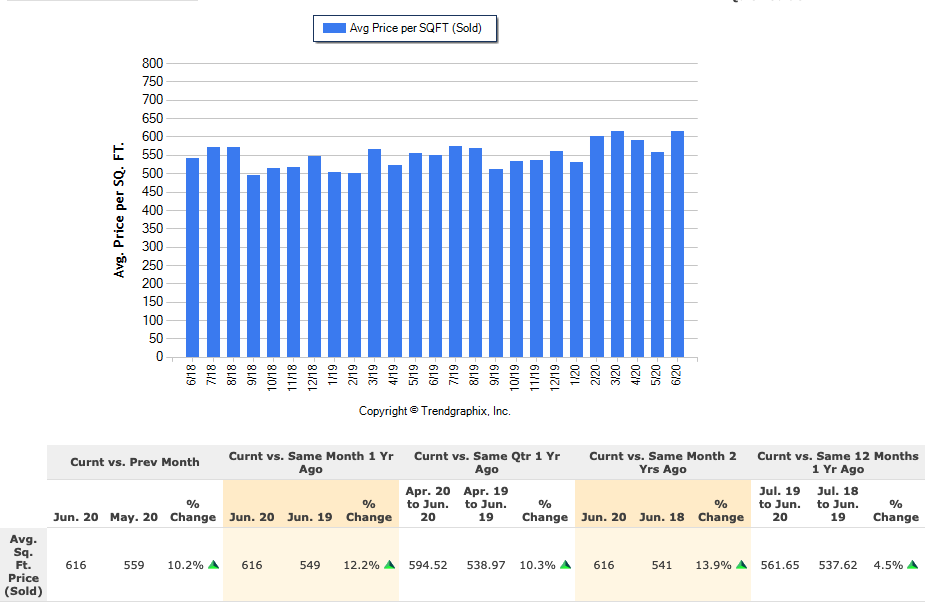

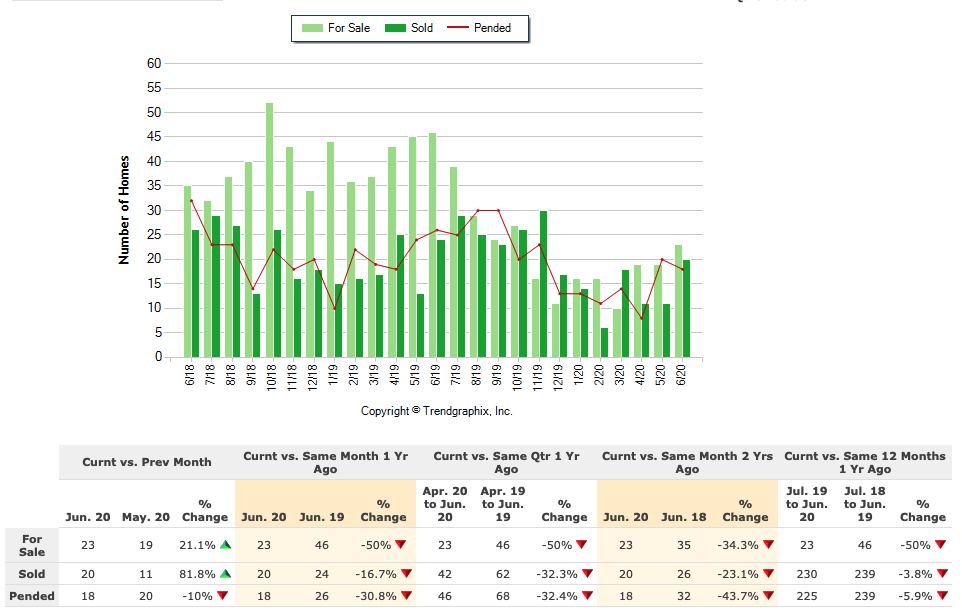

Homes under $2 Million, on the east end of Pasadena (91104), mostly Pre-War Homes, filtered for just single-family properties. Data set reflects the last two years. Home values are up but if you are concerned that you are buying at the peak, don’t, historic homes can make major market gains through renovations and tasteful improvements. A fast market will require a realtor that knows how to navigate it. It won’t be easy for buyers in this category but it can be done. Sellers are sitting pretty.

Inventory: 23 homes were for sale in June, 20 homes sold. June 2019 saw 46 homes for sale and 24 homes sold. Half the inventory will drive competition for these prized properties and prices as well.

Price Per Square Foot: Up 12% over June 2019, 14% over June 2018 PPSF. Demand is up, inventory is low, values go up.

Days on Market: Homes are selling on average in 23 days compared to a 32-day average last year in June. Homes are selling and selling fast. Buyers making offers under list generally won’t work here.

Average Price: Average home price for sold homes is up 5% over last year this time at an average sale price of $986,000. Listing price averages hit a two-year high.

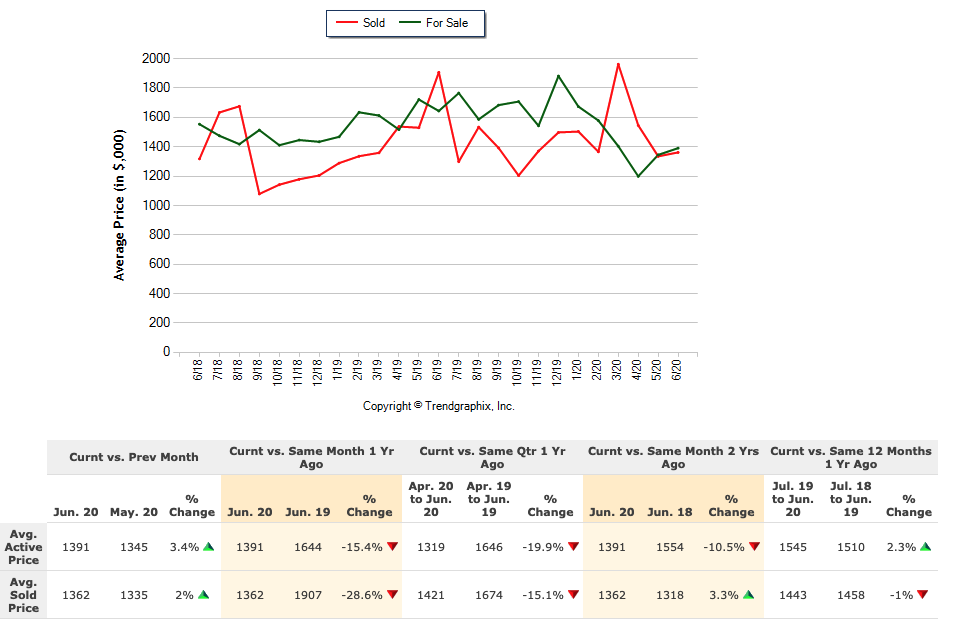

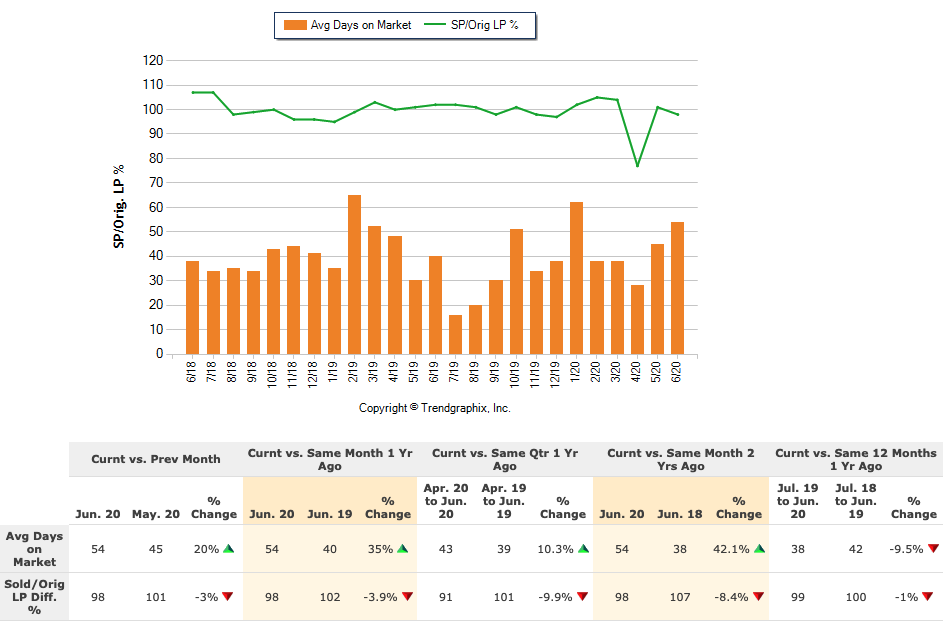

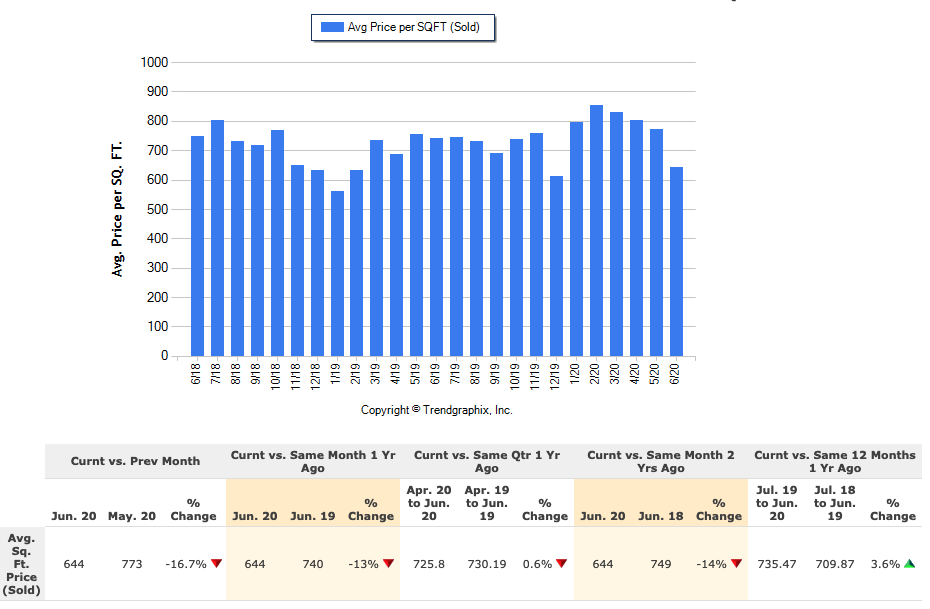

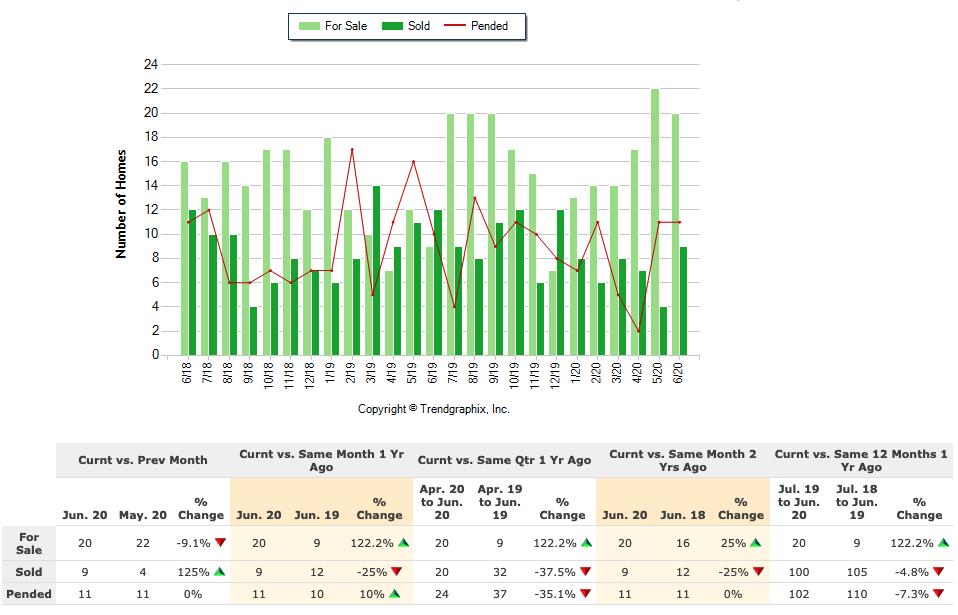

South Pasadena

Homes under $4 Million, filtered for just single-family properties. Data set reflects the last two years. South pasadena is historically low in turnover, but there is a surplus of homes for sale. Buyer’s have a major advantage here.

Inventory: The number of homes for sale in June doubled when compared to June 2019 but 25% less homes actually sold in the same comparison.

Price Per Square Foot: PPSF is down 13% for Year Over Year and on a decline since Covid hit. It’s a great time to look at South Pasadena to invest.

Days on Market: Homes are selling in 54 days vs 40 last year with homes selling for 98% of list price.

Average Price: Average sold price is down 28% year over year. Advantage Buyer. Sellers should make extra effort to properly prep their homes to maximize the sale.

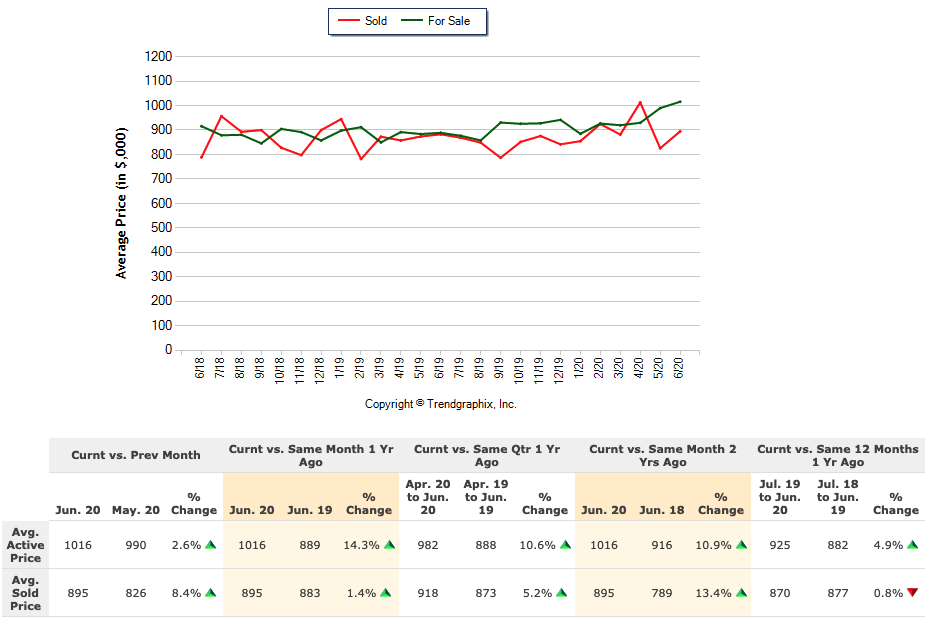

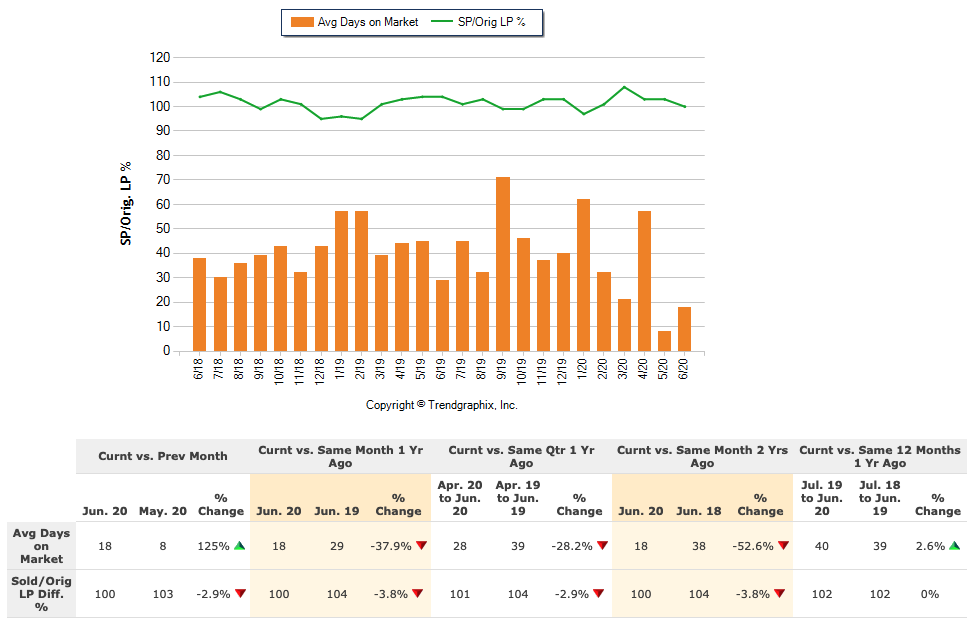

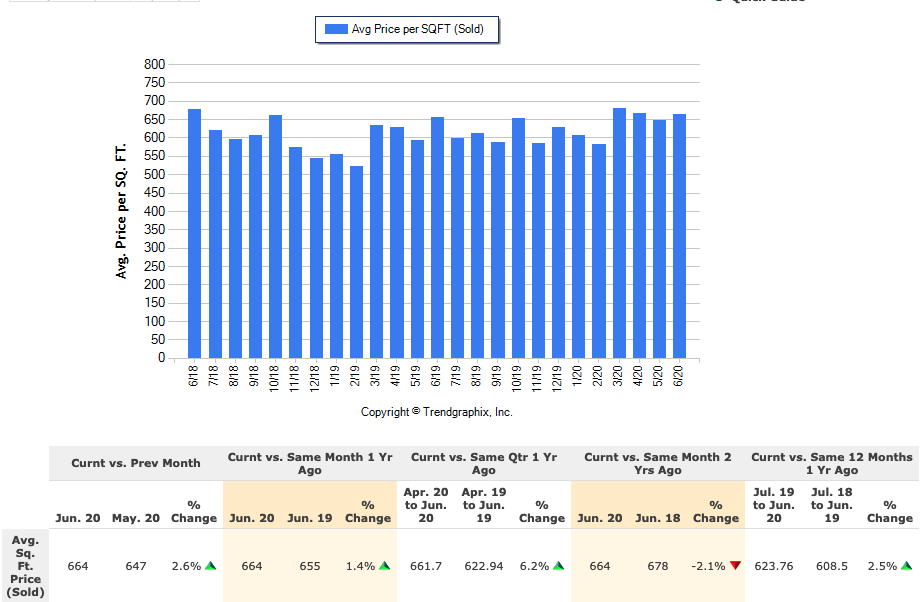

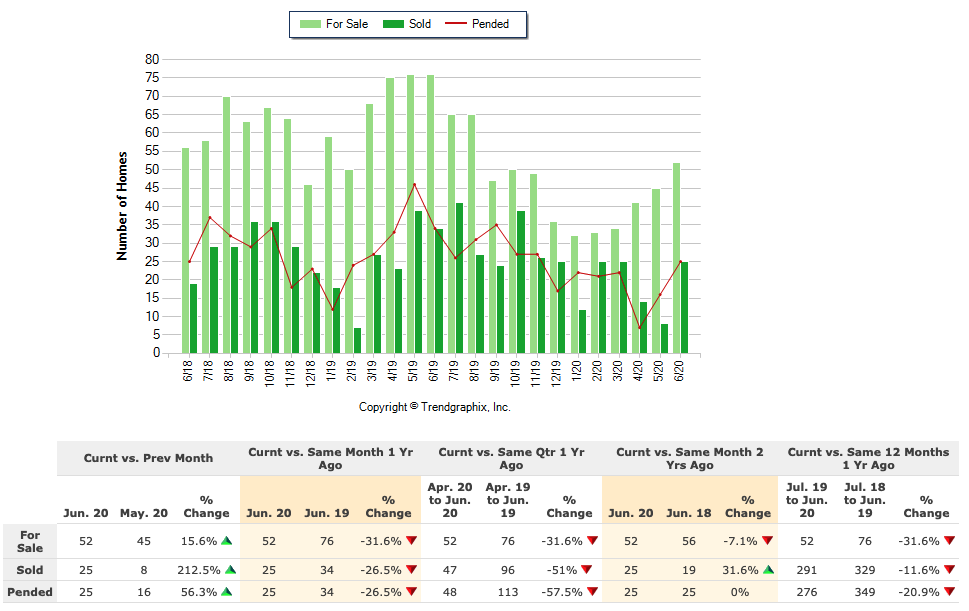

Highland Park

Homes under $2 Million, mostly Pre-War Homes, filtered for just single-family properties. Data set reflects the last two years. A wildly popular area for first time home buyers, you will be faced with buyer competition here. If values are up during Covid, think what they will do once things return to normal.

Inventory: The number of homes for sale in June down is over 31% in Highland Park when compared to June 2019. Number of homes sold followed suit. Like the historic areas of Pasadena sellers have a slight advantage due to tight inventory.

Price Per Square Foot: Holding steady in the mid- $600 range. PPSF is up only 1.4% vs June 2019. Northeast LA is a solid investment like it has been over the past years by the lack of fluctuation in PPSF.

Days on Market: This is a hyper-fast market. Homes are selling in a mere 18 days vs the 29 days it took last year at this time. While we think everyone is fleeing to the countryside, we see that is not the case for couples 40 and under who are flocking here.

Average Price: While listed prices are up 14% the sales prices here are only up 1.4% (up 13% since June 2018). The proximity to Downtown and the culture of HP will be a draw for years to come.

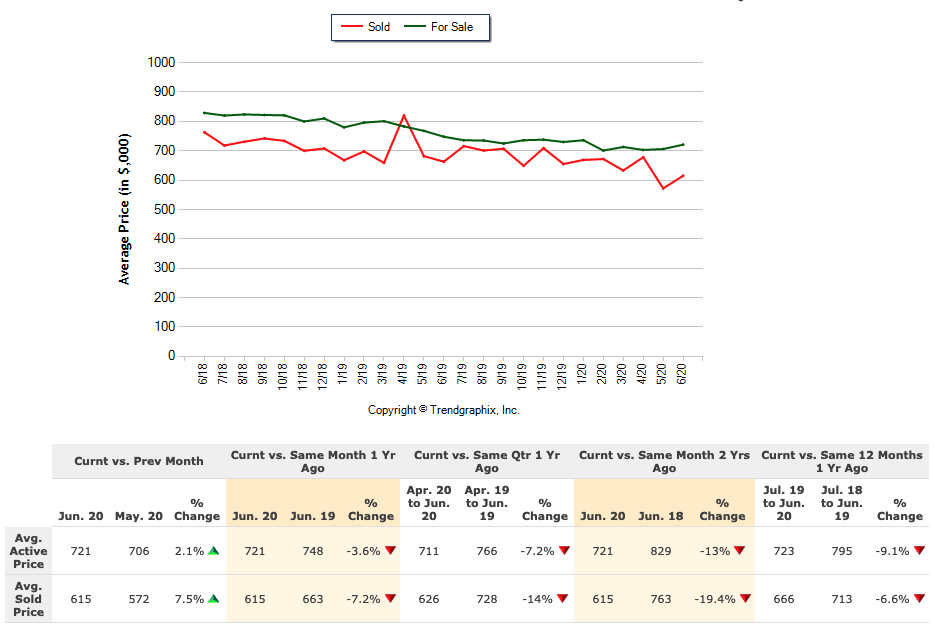

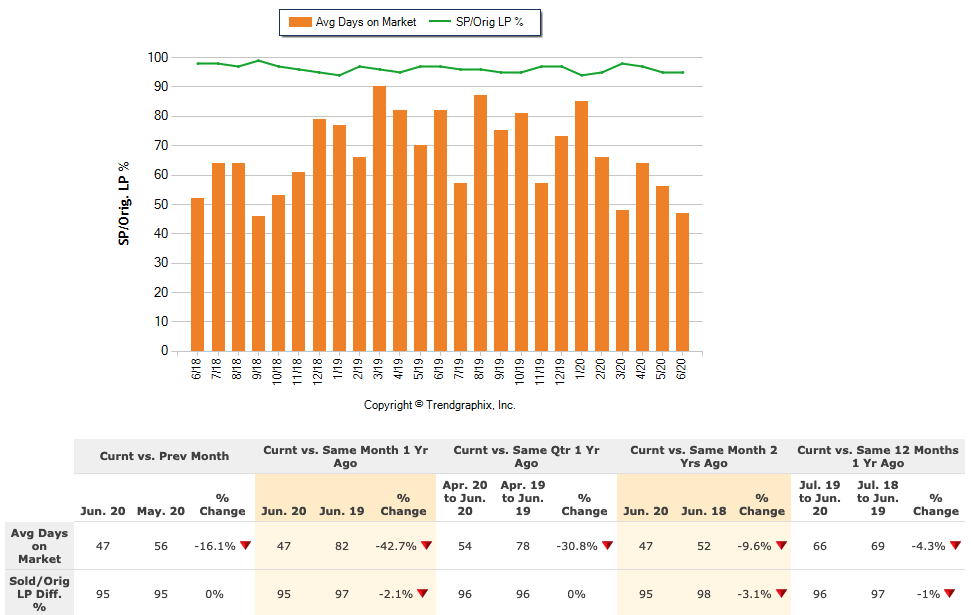

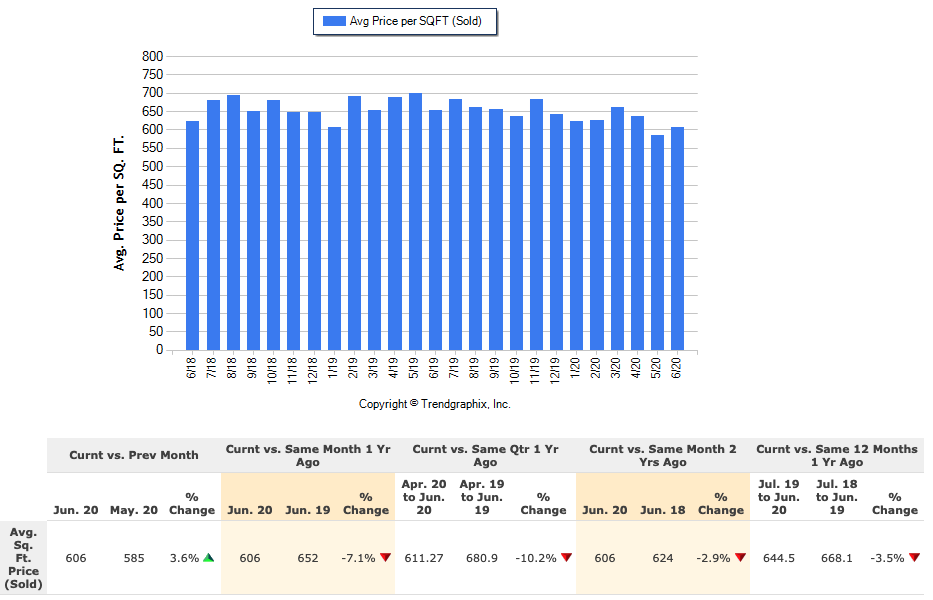

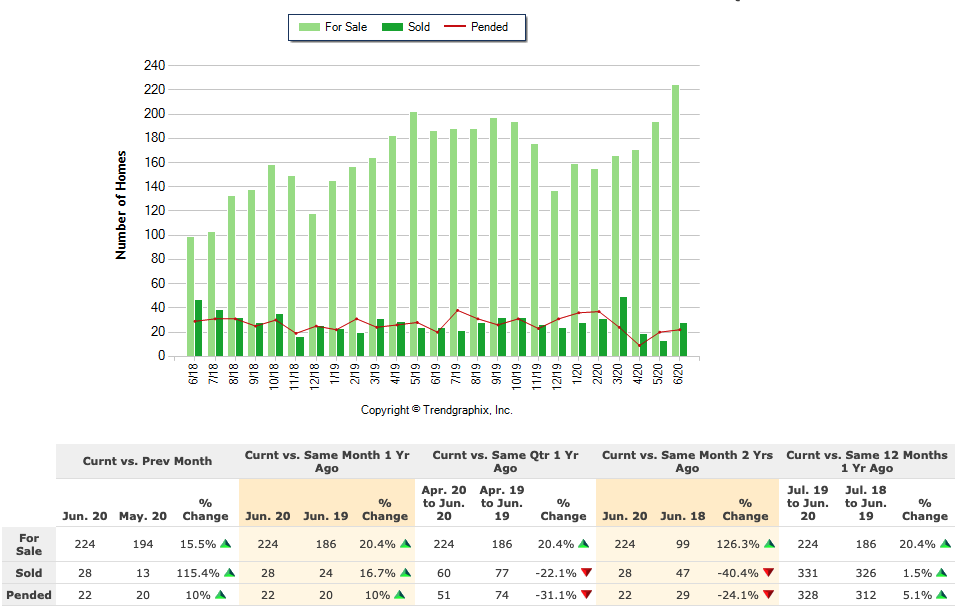

Downtown LA

Condos under $1.5 Million, all areas of DTLA (Arts District, Historic Core, South Park etc). No Single Family Homes. Data set reflects the last two years. There is a peak of lofts for sale, buyers have a major advantage these days. Sellers are nervous, buyers have an advantage. The future of DTLA will be bright, still lots of development on the horizon and the area is so unique, it will always have demand. Look for specific pockets that fit your needs.

Inventory: Big jump in lofts for sale in DT. 224 units for sale vs 186 for sale last year in June. The number of sold units is up also. 28 units sold in June vs 24 in June 2019. While skeptics think DT will be a vacant wasteland, that is not the case. More inventory on the market will drive down values, but investors and those looking for urban feel will find DT to be the only option in SoCal for that vibe.

Price Per Square Foot: We are seeing a slight dip in values when looking at PPSF. DT lofts are down 7% in value YoY. We haven’t seen it this low since January 2019.

Days on Market: Surprisingly lofts are selling faster now compared to June 2019. 42% faster. We do see units, on average selling at 95% of list prices. Market fear is getting those under list price offers accepted. Great for buyers.

Average Price: We are seeing a downward trend on average sales price in DTLA. Down 7% this year and down 19% from June 2018. Looking back at data from five years ago, I can see the average price for a loft is $615,000 now. Last time it was that low was Winter 2017. If you are looking for investment, look in Downtown. While the cultural draws are on hold right now, that won’t last forever.

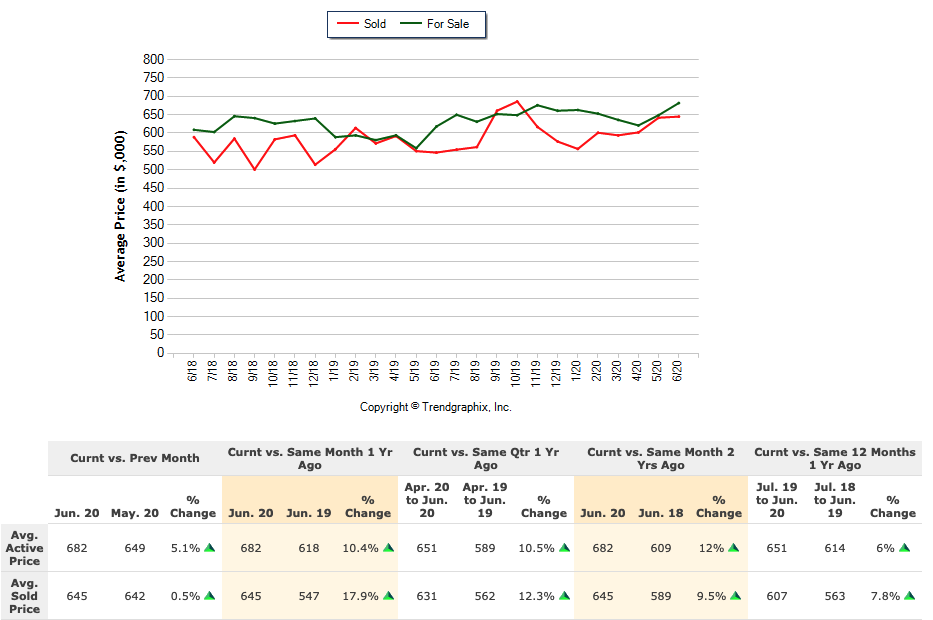

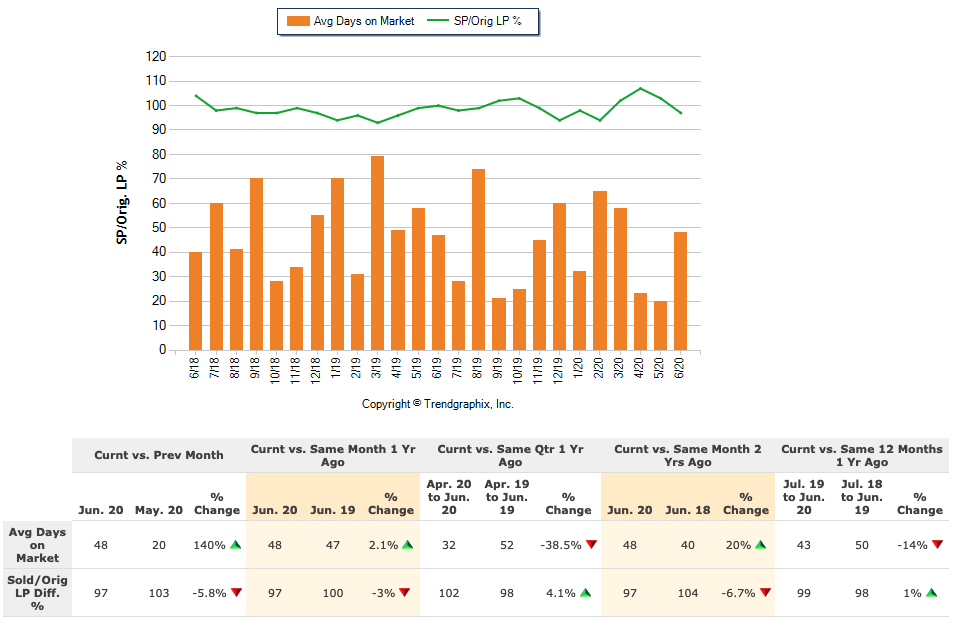

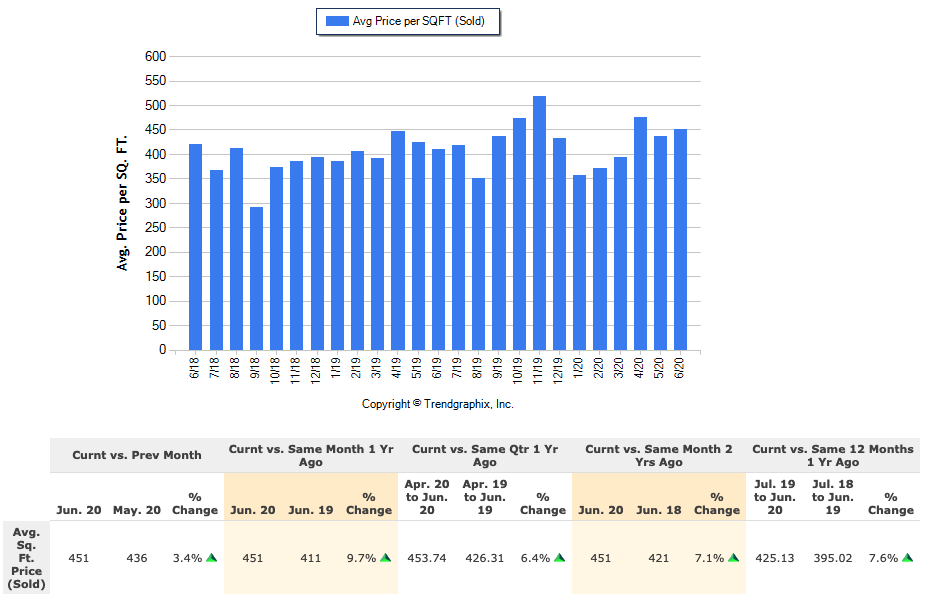

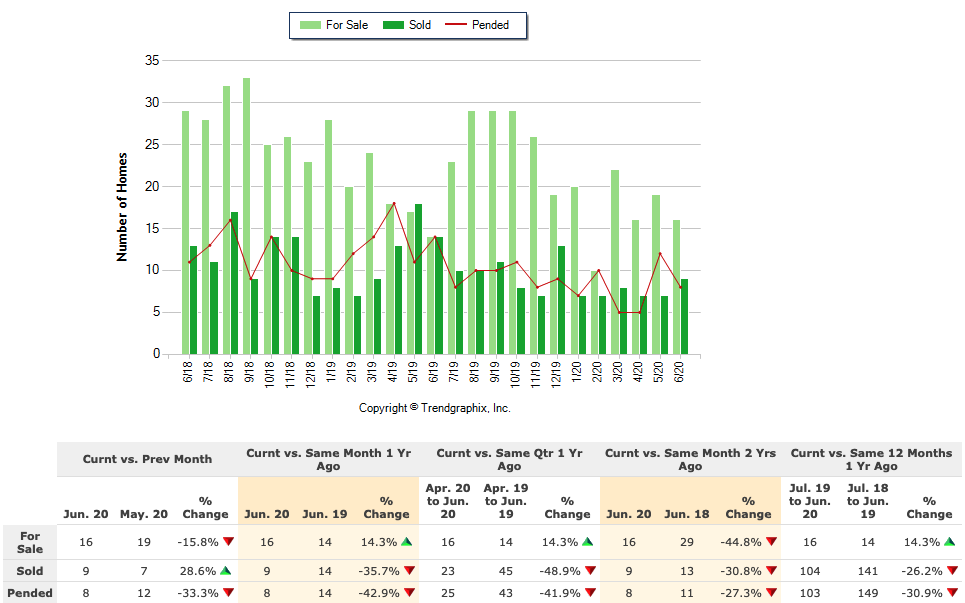

South LA - Exposition Park

Expo Park (Zip code 90062) is south of the 10 Fwy and West of the 110. These neighborhoods date back to the early 1900’s and are chock full of amazing Craftsmans and Spanish Revivals. What the area lacks in Yoga Shops in Latte’s, it makes up for in potential. All Single Family Homes. Data set reflects the last two years.

Inventory: Inventory is up slightly YoY but half of what we see in traditional late summer peaks here. 14 homes sold in this area in June 2019 vs 9 that sold June 2020. The area does not see a ton of turnover (a good thing). My guess is we will see an uptick in listings and sales early next year here.

Price Per Square Foot: PPSF has been edging up for a while here and 2020 was no different. Per square foot numbers are up almost 10% here.

Days on Market: Despite a global pandemic we see no change in the days it takes to sell a property here. Indications of a very stable market. Not super fast, less competition for buyers.

Average Price: I have been stating that this area is a solid investment for years and my prediction is holding true. Home values are up 18% year over year. As LA County begins to shift much-needed attention to support neighborhoods like these, we will see further increases in values. The massive George Lucas Museum investment will change this area dramatically in years to come. The lattes will come, it just takes time to brew.

In review.

As we can see every LA enclave is different. Some values are down which are great for buyers and more impactful to a seller, but many sellers have been in their homes 10 years or longer so they are up in values. Buyers can see stability in most markets and stiff competition in others. Note to buyers, those taking the wait and see approach in the hopes to buy at the lowest price in the market will be saddened to know that this is impossible to do. You will never know the bottom of the market until the market has corrected. Find a home that suits your needs. Your investment will grow in time as the data above shows.

When people ask me about the pandemic market status, I always say it is as lively as ever. While the mass media loves to portray a mass exodus from SoCal, I just don’t see it. What I do see is opportunities for both sellers and buyers. Luxury homes may be feeling the pressure of the market but that is generally not the world I work in.

Buyers in markets with short days on market will have to contend with multiple offers and need to learn the strategies required to get into one of these homes. Sellers in markets with long days on markets are going to need to properly prep and market their homes in this “no open house” world. Ask about Compass Concierge where we can front you the money for repairs and market preparation.

If your goal is to own a home with character or sell one that has character to showcase, I welcome the conversation. I am very thankful to have been busier than ever and as always strive to go the extra mile for those I work with.

MORE ARTICLES

Michael Robleto

REALTOR®-Compass Real Estate

213-595-4720

Michael Robleto is a Los Angeles based REALTOR® that specializes in Historic Pre-War residential properties and those with architectural merit. Home buying and home selling is extremely challenging in Los Angeles County. Michael uses his vast knowledge of historic homes, residential construction and modern-day marketing and digital technology to predict and solve the many problems that arise in real estate transactions. His client accolades of insight, integrity, and hard work support the fact that he is not your average agent.

Michael leverages his personal passion for historic architecture to provide his clients with the unknown insight on the pros and cons of older homes. Michael, the son of a contractor, a California native, grew up in an older Bungalow home and has spent 23 years in Southern California admiring the unique architecture of the region. He often writes on homeownership strategy, historic residential architecture and related topics that can be found on Facebook, YouTube, Twitter and Instagram under the common profile name of his blog; BungalowAgent or at www.BunaglowAgent.com/blog.

Michael is a committee member and frequent volunteer for the preservation efforts of Pasadena Heritage, the LA Conservancy as well as a supporter of the Five Acres center for children.